The latest November PVC shipment discounts announced by a major Taiwanese manufacturer for Asian markets were higher than market expectations. While the slide has slowed somewhat in early October, recent price levels have clearly helped underline the bearish bias that is pervading the region.

For the seventh consecutive month of declines, the producer lowered prices for Asian markets by $50-70/ton from October prices. New PVC K67-68 quotes for November reduced $70/ton. , to $840/ton CIF India and down $50/ton to $790/ton CIF China, while FOB Taiwan price fell $50/ton to $740/ton.

In early October, most Asian market participants questioned whether the market had

near bottom while they then predict the Taiwanese manufacturer will announce a fresh cut in prices, although the latest drops are higher than what most of them had anticipated.

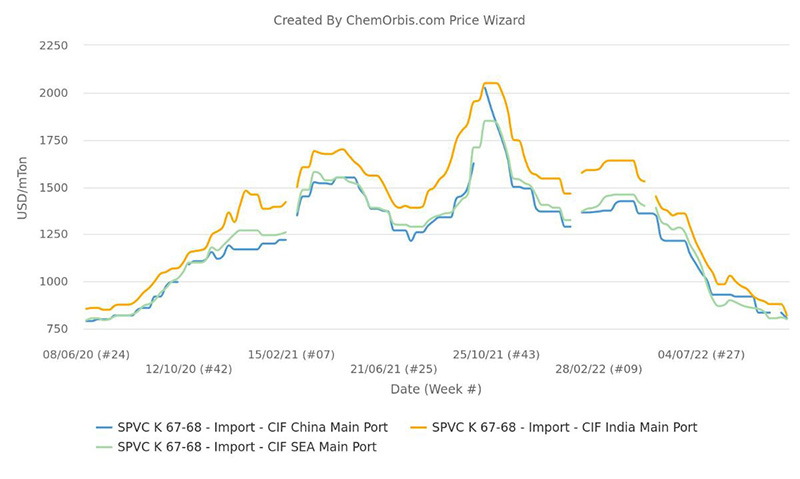

Price down 60% from historic peak in October 2021

The latest price drop has caused the estimated import prices to enter Asian markets 57-60% from the historic peak reached in the second week of October last year. Estimated prices in India, Southeast Asia and China are currently at their lowest in 2 years 3 months.

In India, PVC K67 is currently being quoted in the range of $800-840/ton, with US shipments said to have been bought in the low-end and quotes by the major Taiwanese producer in the high-end. . In Southeast Asia, the latest prices were recorded in the range of 780-820 USD/ton. In China, the latest import price is currently recorded at 790 USD/ton, CIF Taiwan but traders said the purchase price is about 50 USD/ton lower.

US quotes put pressure on the low end

As for the US commodity, traders said that although there have been reported deals at $800/ton CIF India this week, there are still market participants offering bids below the threshold. there. “We have seen export shipments from the US currently being quoted as low as $730/ton FAS Houston,” said a trader in Mumbai.

“The current idea of pricing imports by some Indian buyers at less than $800/ton is unrealistic,” he said. Even the US $800-820/ton quote is too low, considering the FAS price, but this could be the result of oversupply by traders or it could be that a US producer cut inventory before year-end.” He added: “At the same time, we wouldn't be surprised if prices fall below $800/ton in the near term.

The purchase price of US shipments is too low in China

Market participants in China also found that the quote of $790/ton CIF China from the major Taiwanese supplier was still too high to be accepted. “It is very difficult for a Taiwanese manufacturer to compete with other sellers at this price point,” said one converter.

U.S. origin quotes were seen as early as $800/ton CIF China, but traders said buyers are waiting for prices as low as $740/ton. “We have yet to see any reported transactions for US shipments in the past few weeks,” said a major trader in China.

Depreciating local currencies further restrain demand

Market participants have pointed out that the depreciation of Asian currencies against the US dollar makes it difficult to finance imports.

Another trader said: “Inflationary pressures coming soon will also likely keep demand under control.” Furthermore, the latest forecasts have shown a decline in wet season output due to unseasonal rains, reducing the purchasing power of rural people in India. This will certainly affect demand for consumer goods and accordingly plastic.”

Currencies across Southeast Asia, from the Thai baht to the Indonesian rupiah, have hit record lows in recent weeks as the US dollar strengthened on the back of aggressive interest rate hikes by the Federal Reserve. US Federal Reserve. In China, the situation is considered alarming enough that the country's central bank has to step in to protect the weakening yuan. Banks sold large amounts of US dollars to stabilize the yuan.

"Domestic demand has been significantly affected by the rupiah's devaluation against the US dollar," said an Indonesian converter. “Additionally, higher interest rates have made it more difficult to get loans to buy raw materials for our products,” he added.